METRICAL INC. – corporate governance, investment research & solutions –

– News of Expansion of CG research universe –

METRICAL CG Research universe has been increased to 1,808 companies from 511 companies.

METRICAL INC. aims at a pioneering corporate governance (CG) research in the viewpoint of a shareholder/investor, while CG is increasingly becoming a vital factor for investment across the globe. The company believes that maximizing shareholders value for a long term as a goal of a corporation should result in enhancement of capital markets. To do so, it goes without saying that CG should improve not only in reform of board of directors but substantial basis which directly connects to the goal. METRICAL offers research and solutions of CG, focusing on both of global perspective and local issues in JapanCorporate Governance Rating (Monthly Update):

Corporate Governance Ranking Top100 as March 31 2025 – New –

Top 1 : Japan Exchange Group,Inc. (8697)

Top2 : Funai Soken Holdings Incorporated (9757)

Top3 : BRIDGESTONE CORPORATION (5108)

See more Corporate Governance Ranking Top100

Explore Corporate Governance Rating

Corporate Governance Stock Performance (Monthly Update):

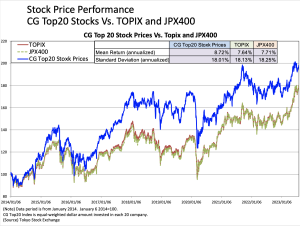

Relationship between CG rating and stock performance: CG Top20 Index vs. Topix & JPX400 as of March 2025 – New –

See CG Top 20 Stock Performance Charts

Corporate Governance Reports (CG topics):

“Corporate Governance of Japan – Linkage of CG and Value Creation – March 2025” April 1 2025 – New –

“Disco (6146) CG Research 8/13/2020” February 7 2021 – New –

“Nichirei (2871) CG Research 8/13/2019” January 12 2020 – New –

“Nintendo (7974) CG Research 4/16/2019” April 16 2019

“Thinking back of equity issues in 2009 and cost of equity” April 6 2017

“Companies improved CG scores 11/2016-11/2017” December 1 2017

“Attribution analysis of change in CG score 11/2016-11/2017” December 1 2017

“Canon (7751) CG Research 4/8/2017” April 9 2017 – New –

“Mandom (4917, JP) CG Research 3/30/2017” 3/30/2017

“Zuken (6947, JP) CG Research 2/21/2017” 2/21/2017

“What company do overseas investors like?” February 3 2017 – New –

“A wrong message from Mid-term Management Plan” November 5 2016

“Cross share holdings” September 5 2016

“Corporate Governance scores comparison 2016 vs. 2015” August 2 2016

“Astellas Pharmaceutical (4503, JP) CG Research” July 14 2016

“Case Study of Mitsubishi Motor” May 27 2016

“Issues Regarding Companies with an Audit Committee” April 9 2016

Investment Research:

“General Packer (6267, JP) 3/14/2020” March 14 2020

“Royal Holdings (8179, JP) 8/19/2018” August 19 2018

“Syuppin (3179, JP) 6/10/2018” June 8 2018

“Royal Holdings (8179, JP) 5/13/2018” May 14 2018

“S.T. CORPORATION (4951, JP) 5/4/2018” May 4 2018

“Tabio (2668, JP) 4/22/2018” April 22 2018

“Watts (2735, JP) 4/21/2018” April 22 2018

“Maxell Holdings (6810, JP) 12/15/2017” December 16 2017

“AP Company (3175, JP) 12/1/2017” December 3 2017

“Syuppin (3179, JP) 11/27/2017” November 27 2017

“Seria (2782, JP) 11/26/2017” November 26 2017

“Tabio (2668, JP) 11/2/2017” November 5 2017

“Watts (2735, JP) 10/18/2017” October 19 2017

“Hitachi Maxell (6810, JP) 9/15/2017” September 18 2017

“Syuppin (3179, JP) 8/20/2017” August 20 2017

“Zuken (6947, JP) 07/16/2017” July 16 2017

“Watts (2735, JP) 7/16/2017” July 16 2017

“AP Company (3175, JP) 6/12/2017” June 12 2017

“Hitachi Maxell (6810, JP) 6/7/2017” June 9 2017

“Syuppin (3179, JP) 5/28/2017” May 28 2017

“Hard-Off (2674, JP) 05/27/2017” May 27 2017

“Seria (2782, JP) 5/20/2017” May 20 2017

“S.T. CORPORATION (4951, JP) 5/6/2017” May 6 2017

“Anritsu (6754, JP) 5/4/2017” May 4 2017

“Watts (2735, JP) 4/30/2017” April 30 2017

“Arcland Service Holdings (3085, JP) 2017/3/10” March 13 2017

“Syuppin (3179, JP) 2/20/2017” February 20 2017

“Hitachi Maxell (6810, JP) 2/13/2017” February 13 2017

“Anritsu (6754, JP) 2/12/2017” February 12 2017

“Watts (2735, JP) 1/25/2017” January 25 2017

“Asahi Holdings (5857, JP) 1/17/2017” January 18 2017

“Seria (2782, JP) 1/10/2017” January 11 2017

“Hitachi Maxell (6810, JP) 1/3/2017” January 4 2017

“Syuppin (3179, JP) 12/30/2016” December 30 2016

“Hard-Off (2674, JP) 12/22/2016” December 24 2016

“Zuken (6947, JP) 12/22/2016” December 24 2016

“Hitachi Maxell (6810)” June 7 2016

“Changing Inbound Consumption” March 29 2016

“Other operating revenue spoiling retailers” February 27 2016

METRICAL INC. is a corporate governance (CG) research and consulting company, offering CG ratings and solutions to investors, public companies and other wide range of organizations globally. The company is an independent leading CG research firm in Japan where CG is increasingly recognized as an important element on corporate management in these days. Thus, CG research and solutions would become an essential component of global capital markets and play important to contribute to transparency of the markets and maximize shareholders’ value in Japan.

METRICAL INC. provides corporate governance research and rating services, and analysis including advisory services with solutions and customized profound research on investment research and IR services.

Go to Investment Research & IR